real property gains tax act 1976

And inserted before period at end or real property and all gains or losses from the forfeiture of good-faith deposits. The United States of America has separate federal state and local governments with taxes imposed at each of these levels.

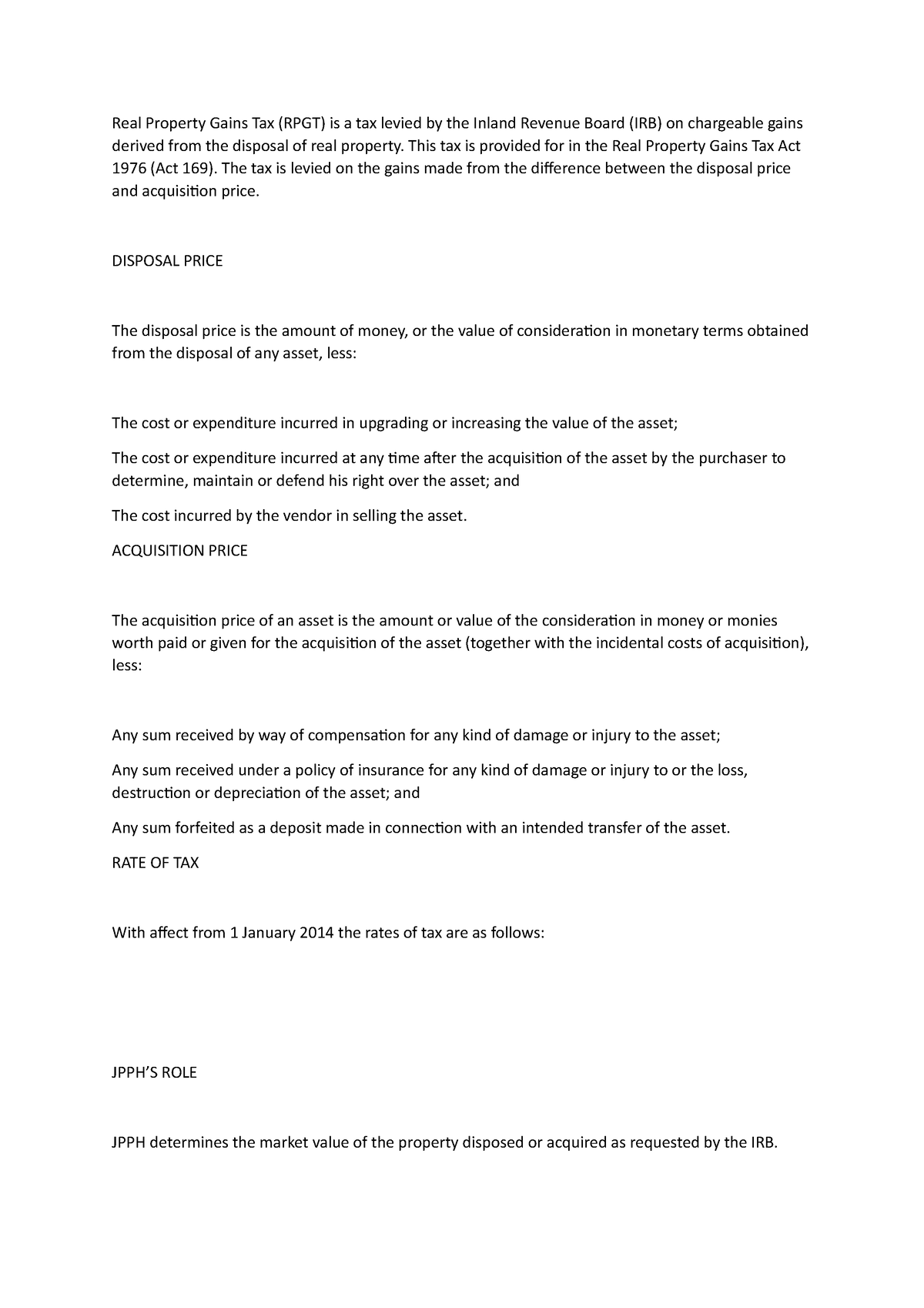

Timing In Filing Real Property Gains Tax Forms

The empty string is the special case where the sequence has length zero so there are no symbols in the string.

. Keep reading by creating a free account or signing in. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform. Subsequently the taxpayer-seller contracted to convey the real property to buyer.

The Tax Reform Act of 1986 repealed the exclusion of long. Summary of HR1 - 115th Congress 2017-2018. 1976 there shall be.

7279 otherwise known as the Urban Development and Housing Act of 1992 and other related laws residential lot valued at. A real property trade or business electing out of the limitation on the deduction for interest must use the ADS to depreciate nonresidential real property. The 1981 tax rate reductions further reduced capital gains rates to a maximum of 20.

Capital gains tax rates on real estate What is the capital gains tax on property sales. The Service filed a NFTL before the closing date on the real property. It was the most serious financial crisis since the Great Depression 1929.

West Virginia October 11 West Virginia Gov. This Act may be cited as the Real Property Gains Tax Act 1976 and shall be deemed to have come into force on 7 November 1975. The date of the enactment of the Tax Reform Act of 1984 referred to in subsec.

Predatory lending targeting low-income homebuyers excessive risk-taking by global financial institutions and the bursting of the United States. A regular or residual interest in a REMIC shall be treated as a real estate asset and any amount includible in gross income with respect to such an interest shall be treated as interest on an obligation secured by a mortgage on real property. The Fourth Circuit held that buyer took the real property with the federal tax lien attached to it because the Service filed a NFTL before the buyer qualified as a purchaser under IRC 6323a.

Taxes are levied on income payroll property sales capital gains dividends imports estates and gifts as well as various feesIn 2020 taxes collected by federal state and local governments amounted to 255 of GDP below the OECD average of 335 of. Also increased was the one-time exclusion of gain realized on the sale of a principal residence by someone aged at least 55. Except that if less than 95 percent of the assets of such REMIC are real estate assets determined as if the real estate investment trust.

News Sports Betting Business Opinion Politics Entertainment Life Food Health Real Estate Obituaries Jobs. Of gains on the sale of real property if the owner owned and used it as primary residence for two of the five. Economics ˌ ɛ k ə ˈ n ɒ m ɪ k s ˌ iː k ə- is the social science that studies the production distribution and consumption of goods and services.

The Jerusalem Post Customer Service Center can be contacted with any questions or requests. Tax policies that have been enacted by lawmakers are predicted to slow revenue growth. Income tax was announced in Britain by William Pitt the Younger in his budget of December 1798 and introduced in 1799 to pay for weapons and equipment in preparation.

1 constitutionally permitted property taxes based on the assessed value of the property. The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 PubL. The amount of any gift tax paid on the gift Form 709 United States Gift and Generation-Skipping Transfer Tax Return.

We care about the privacy of our clients and will never share your personal information with any third parties or persons. Economics focuses on the behaviour and interactions of economic agents and how economies work. Formally a string is a finite ordered sequence of characters such as letters digits or spaces.

The act was first introduced in 1976 under Real Property Gains Tax Act 1976 as a way for the government to limit property speculation and prevent a potential bubble. We welcome your comments about this publication and suggestions for future editions. As long as you lived in the property as your primary residence for a total of 24 months within the five years before the homes sale you can qualify for the capital gains tax exemption.

The donors adjusted basis just before the donor made the gift. Jim Justice to propose a plan to eliminate personal property. The financial crisis of 20072008 or Global Financial Crisis GFC was a severe worldwide economic crisis that occurred in the early 21st century.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Section 3 of Article XIII D provides that no tax assessment or property-related fee or charge shall be assessed by any agency upon any parcel of property or upon any person as an incident of property ownership except. 11597 text is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act TCJA that amended the Internal Revenue Code of 1986Major elements of the changes include reducing tax rates for.

94455 1901b1V struck out provision that for purposes of computing the normal tax under section 11 the taxable income and the dividends paid deduction of such real estate investment trust for the taxable year computed without regard to capital gains dividends would be reduced by the deduction provided by section 22 relating. Microeconomics analyzes whats viewed as basic elements in the economy including individual agents and markets their. To figure out the basis of property received as a gift you must know three amounts.

NW IR-6526 Washington DC 20224. An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018. The amount for a married taxpayer to file a joint return increased under the Economic Recovery Tax Act to 125000 from the 100000 allowed under the 1976 Act.

2 special taxes receiving a two. 2421 Extension 4 Jerusalem Post or 03-7619056 Fax. P Sale of real properties not primarily held for sale to customers or held for lease in the ordinary course of trade or business or real property utilized for low-cost and socialized housing as defined by Republic Act No.

1 In this Act unless the context otherwise requires accountant means an accountant as defined in subsection 1533 of the Income Tax Act 1967 Act 53. A single person was limited to an exclusion of 62500. The fair market value FMV of the property at the time the donor made the gift.

Real Property Gains Tax RPGT is an important property-related tax in Malaysia that applies to property sellers and many are often left confused when there are multiple updates. A uniform Land tax originally was introduced in England during the late 17th century formed the main source of government revenue throughout the 18th century and the early 19th century. Founded in 1976 Bankrate has a long track record of helping people make smart financial choices.

Laws Of Malaysia Real Property Gains Tax Act 1976

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

Rpgt 1976 Rpgt 1976 Tuesday 11 8 Wednesday 12 Real Property Gains Tax 1976 In Malaysia We Studocu

Indexing Capital Gains For Inflation Would Worsen Fiscal Challenges Give Another Tax Cut To The Top Center On Budget And Policy Priorities

Chap 8 Real Property Gain Tax Notes Pdf 1 Chapter 8 Real Property Transactions Real Property Gains Tax Act 1976 Real Property Gains Tax Act Course Hero

Solution Slides On Real Property Gains Tax Studypool

Solved Question 3 Malaysia Has A Limited Scope Of Tax On Chegg Com

W O Real Property Gains Tax Act 1976 Act 169 Selected Orders As At 10 October 2020 Shopee Malaysia

Property Law News Richard Wee Chambers

Amendments To The Stamp Act 1949 And Real Property Gains Tax Act 1976 Shearn Delamore Co

All You Need To Know About Real Property Gains Tax Rpgt

Indexing Capital Gains For Inflation Would Worsen Fiscal Challenges Give Another Tax Cut To The Top Center On Budget And Policy Priorities

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Borders Real Property Gains Tax Act 1976 Act 169 Selected Orders As At 25 5 21 Lazada

Real Property Gains Tax Part 1 Acca Global

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

Comments

Post a Comment